There is no need to be nervous at interview - we want you to do well and to show us your potential and what you can do. Preparation is essential and well prepared candidates are more confident, provide more thorough and focused answers and are therefore more likely to be successful.

Use our step by step guide to ensure you take the time to prepare wisely; the key is to ensure your preparation is carefully planned and focused.

Step 1 - Focus: structure and prepare

Preparing for, and being interviewed is similar to sitting an exam; you won’t have time to cover everything, instead you will need to identify the key points and focus on the relevant material.

Firstly, you should congratulate yourself in being selected for interview stage and have confidence in your ability. Then, ask yourself the following questions:

- What will the interviewers want to know?

- An interview is not an opportunity to divulge everything you know- instead you need to focus on what is relevant to the company and the position you’re applying for

- To identify what is most relevant, you will need to fully understand the role, it’s requirements and the key skills and competencies required

- How are you going to sell yourself?

- What is your unique selling point? I.e. what sets you apart from the competition?

- How do you want the interviewers to remember you after the interview – what key points do you want them to recall?

- How will you be assessed?

- You can’t start your preparation until you know what you are preparing for

- Read the interview format thoroughly to identify how you will be assessed (i.e. Interviews, case study exercises, and tests). If you’re unsure – ask.

- What are the core competencies required for the role?

- Your interview performance and ultimately if you are successful or not, will be dependent on how you perform against core competencies

- Identify what are the key competencies required for the role and for the company

- What examples do you have to demonstrate each competency? Have you considered examples outside academia (i.e. sports, music, drama, volunteering, charity, mentoring, societies or other extracurricular activities)

- What achievements are you most proud of and why – which competency do they demonstrate?

Step 2 – Interview questions: types and examples

Interviewers will use a variety of questions to assess your ability against each competency. Ensure you are familiar with each type of question and how to structure your answers accordingly.

Types of interview questions may include:

- Competency based questions

- These require you to provide a real life example to explain how you behaved in a certain situation. Past behaviour is used as an indicator to assess potential future performance

- Delivering a structured answer is crucial - research the STAR method to guide you

- Top Tip: Ensure your examples are varied and recent (the more recent the past behaviour; the greater the indication of future ability)

- Technical questions

- Practice! There are many online resources or books available with practice questions

- Questions may include basic accounting, valuation, brain teasers and mental arithmetic

- Top tip: Brain teasers – the key is not the answer; it is the how you derive at the answer. The interviewer is assessing your ability to formulate a logical and methodical response

- CV, cover letter and application questions

- Ensure you have thoroughly re-read each document and identify any obvious questions

- Top tip: Practice articulating your experience in a concise and structured manner out loud (it doesn’t always sound the same as when you practice in your head).

- Industry related questions

- Interviewers will assess your interest, understanding and industry knowledge

- Top tip: Form an opinion – digest the information you read and form your own judgment. Use facts and statistics to back up your conclusions

Examples of interview questions

- Tell me about yourself

This is one of the most popular interview questions. It allows the interviewer to assess how you react in an unstructured situation and you answer provides an insight to what you think is most important.

Tip – focus on what will be of most interest to the interviewers. Ensure your answer is structured, brief and highlights your most important achievements.

Follow up questions may include:

- Why did you choose your place of study?

- What courses have you most / least enjoyed and why?

- Talk me through your internship experiences

- What are you interests and hobbies (outside academic)?

- What are the most important things to you in a job?

- Why banking?

We look for people who have a strong interest in investment banking. Interview Questions will determine how motivated you are and your rationale behind your decisions.

- Why do you want to work in investment banking?

- What do you think an Analyst does on a typical day?

- Why are you interested in this division?

- Where do you see yourself in five years? Ten years?

- Explain the financial crisis

- If I gave you a million dollars today, how would you invest your money?

- Which business publications do you read and why?

- Why Nomura?

We want to employ graduates who are passionate about joining Nomura and representing our brand.

- Why do you want to work for Nomura?

- What differentiates us from our competitors?

- What is the share price of Nomura today?

- What do you hope to get out of a job?

- What other banks are you interviewing with?

- Why you?

Your interviewer’s want to understand what sets you apart from the competition - sell yourself.

- Why should we hire you?

- What skills have you got that make you suited to the role?

- What are your strengths/development areas?

- What is your greatest achievement and why?

- General – competency questions

Show us proof that you are the kind of graduate we are looking for. Give concrete examples from any aspect of your life that show where you have personally made a difference.

- Tell me about a time when you were creative

- Tell me about a time when you had to manage conflicting priorities

- Tell me about when you have missed an important deadline

- What has been your biggest failure, professional or personal - and what did you learn?

- Describe an occasion when you have had difficulties working in a team

- What is the biggest risk you have ever taken?

- How would you deal with a difficult client that puts you under pressure?

- If a client told you that they wanted to improve their portfolio performance in the next 12 months, what would you suggest as potential strategies

Step 3 - Research

There are a number of readily available resources to help you prepare. Make sure you fully utilise all resources available to you. These may include:

- Online resources: Company website, press releases, annual reports, research publications, social media and online forums

- School career services and recruitment events

- Networks – academic Staff, alumni, peers, family and friends – even if they do not have a financial services background, they can help you practice questions

Step 4 – Your questions

An interview is a two way process. It is an opportunity for you to assess if the company, role and culture is right for you. You will be given time to ask questions at the end of the interview, so you should ensure you use this time wisely.

- Plan questions to ask in advance - ensure they are relevant, well-thought-out and to the point

- Show you’ve done your research and use the opportunity to demonstrate your interest

Step 5 – Plan the interview day

Preparing as much as possible in advance of your interview day will remove many of the inevitable nerves associated with the process.

- Before the interview:

- Dress professionally. Plan you outfit the day before and ensure you wear corporate attire

- Be Punctual. Plan your route and account for delays in public transport

- Aim to arrive 15 minutes before your interview start time. Contact us if problems arise and ensure you have noted the name and contact details of who to contact should this happen

- Take a notebook, a pen (that works) and a calculator. Take a copy of your CV and application form

- Remember: Be polite to everyone you meet, your interview begins as soon as you walk through the door of the building ore recent the past behaviour; the greater the indication of future ability)

- During the Interview:

- Ensure your mobile phone is turned off

- Greet your interviewer(s) with a firm handshake. Remember their name(s)

- Maintain eye contact with your interviewer(s) and be aware of your body language – sit upright, don’t fidget and smile!

- Listen carefully to questions you are asked. If you are unclear about anything, ask for clarification

- Be honest. Back up your answers with real examples. If you exaggerate or lie it will show up in pre-employment checks

- Relax - whether you are successful or not, the interview is a valuable learning experience. Make sure you get something out of it.

- Close the interview – thank your interviewer for their time. If you’ve enjoyed the experience and you look forward to hearing about the next steps – tell us

- After your Interview:

- Be responsive. Following the interview, go back to your recruiter and continue to build a relationship

- If you are offered a position it is unprofessional to renege (to accept and then later decline). This could be the first impression you create in the industry - you never know what the future holds

- If your interview is virtual:

- Stay in a private room with minimal disturbance

- Be aware of the background that interviewers may see

- Position your camera at eye level and ensure sufficient lighting

- Log in in advance and have a trial where possible

- Have your mobile phone next to you in case there is technical issue

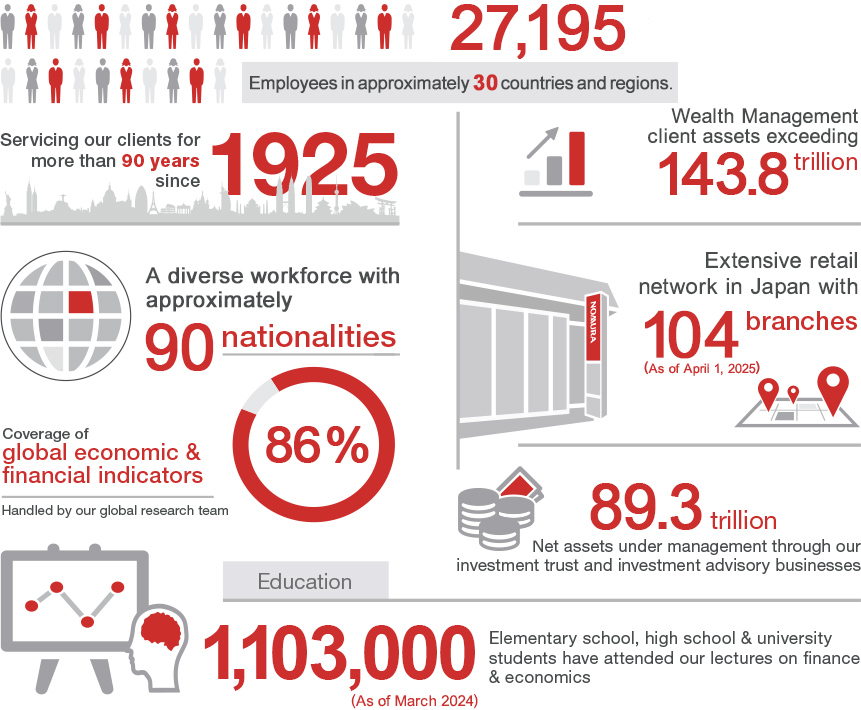

Nomura in Numbers

Nomura in Numbers  Our Philosophy

Our Philosophy  Our Services

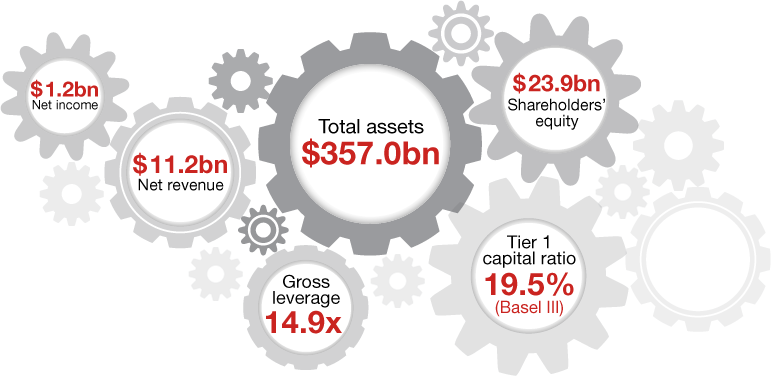

Our Services  Key Financials

Key Financials