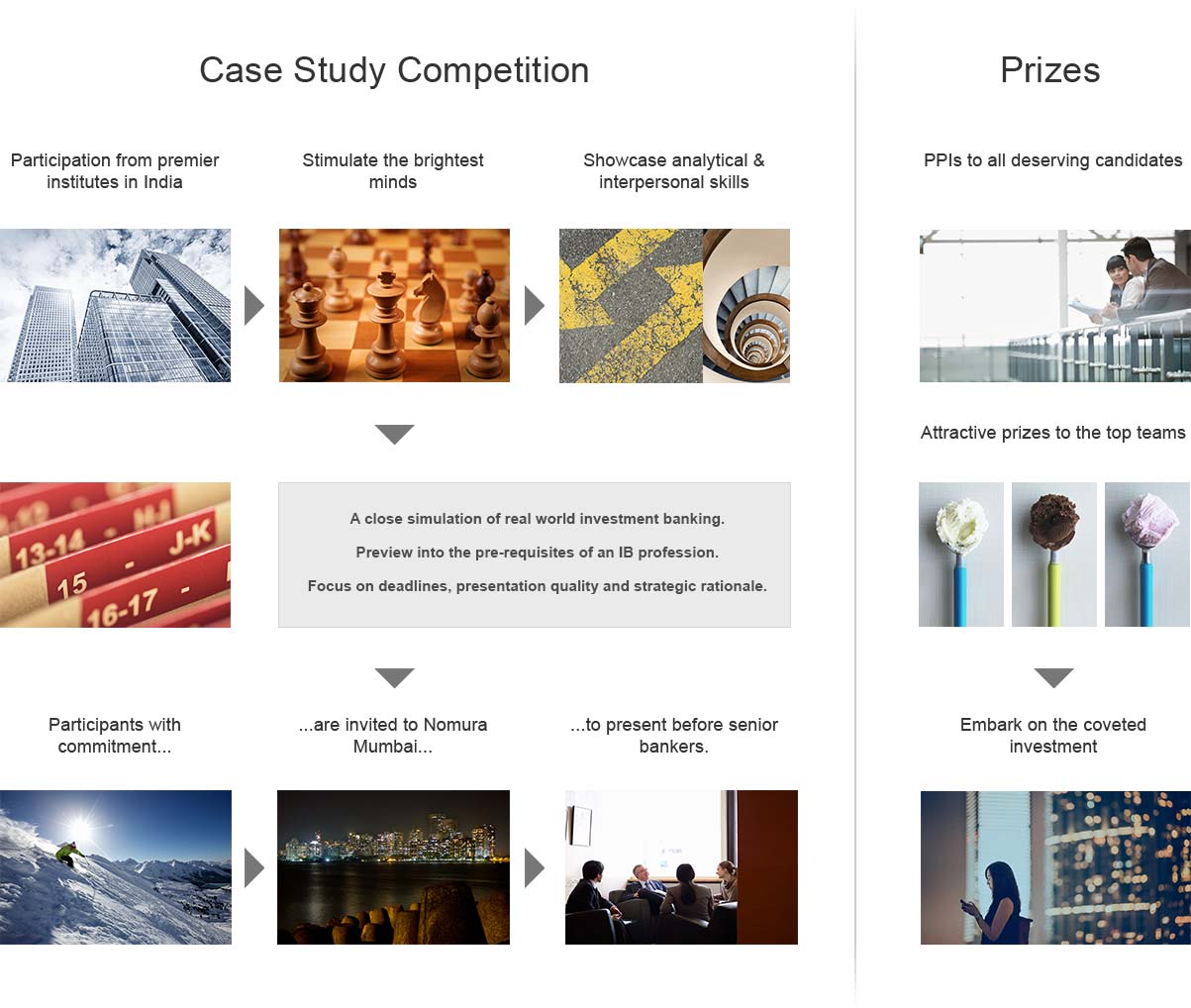

Case study interviews are designed to show us your problem-solving skills and analytical thinking. We will also be looking at how you present yourself and how good your communication skills are under pressure.

Why use case studies?

We use case study interviews because they provide us with insights into your thought processes. Problem solving is often independent of any particular subject expertise you may have and we want to see how you would tackle any of a very wide range of potential case study questions. We are interested in your expertise in general business, your ability to apply your formal education and work experience in an analytical and creative way, and your raw intelligence.

What kind of questions should I expect?

Often a case study is business-related, but it could touch on anything - the question is not designed to test any previously acquired knowledge or experience. You will be asked to prepare an exercise from information given to you when you arrive at the interview. You will have between 45 and 60 minutes to read the data and compile your notes. You will then be asked to make recommendations. Remember, there are no right answers. You should consider all lines of argument and then present one as your chosen opinion, mentioning why you discarded the other possibilities.

How to do well

- Practice extensively beforehand. Research case study examples on the internet and use them to build your experience.

- Ensure that you are able to present your pitch concisely and articulately. You will have a very limited time to get the main points across before the interviewer starts asking you questions on your rationale.

- Listen carefully to the question. If you like, repeat it back to your interviewer to make sure you have understood fully.

- Don't jump into your answer immediately. Take a moment to collect your thoughts, and get ready.

- Remember that we are not looking for a 'correct' answer. It is the route you have taken to reach your answer that is important to us.

- Ask questions. Asking the right questions will be key to proving that you have the analytical skills we expect. The interview is meant to be interactive.

- Construct a logical framework with which to explore the critical issues of the case.

- Prioritize the issues and objectives. Don't get bogged down trying to deal with every aspect.

- Don't be afraid to think outside the box. Creativity is seen as a major asset at Nomura.

Further reading

http://www.wikijob.co.uk/wiki/case-study

http://www.casequestions.com

There is no need to be nervous at interview - we want you to do well and to show us your potential and what you can do. Preparation is essential and well prepared candidates are more confident, provide more thorough and focused answers and are therefore more likely to be successful.

Use our step by step guide to ensure you take the time to prepare wisely; the key is to ensure your preparation is carefully planned and focused.

Focus - Structure and Plan your Preparation

Preparing for, and being interviewed is similar to sitting an exam; you won't have time to cover everything, instead you will need to identify the key points and focus on the relevant material.

Firstly, you should congratulate yourself in being selected for interview stage and have confidence in your ability. Then, ask yourself the following questions:

- What will the interviewers want to know?

- An interview is not an opportunity to divulge everything you know- instead you need to focus on what is relevant to the company and the position you're applying for

- To identify what is most relevant, you will need to fully understand the role, it's requirements and the key skills and competencies required

- How are you going to sell yourself?

- What is your unique selling point? I.e. what sets you apart from the competition?

- How do you want the interviewers to remember you after the interview – what key points do you want them to recall?

- How will you be assessed?

- You can't start your preparation until you know what you are preparing for

- Read the interview format thoroughly to identify how you will be assessed (i.e. Interviews, case study exercises, and tests). If you're unsure – ask.

- What are the core competencies required for the role?

- Your interview performance and ultimately if you are successful or not, will be dependent on how you perform against core competencies

- Identify what are the key competencies required for the role and for the company

- What examples do you have to demonstrate each competency? Have you considered examples outside academia (i.e. sports, music, drama, volunteering, charity, mentoring, societies or other extracurricular activities)

- What achievements are you most proud of and why – which competency do they demonstrate?

Interview Questions

Interviewers will use a variety of questions to assess your ability against each competency. Ensure you are familiar with each type of question and how to structure your answers accordingly.

Types of interview questions may include:

- Competency based questions

- These require you to provide a real life example to explain how you behaved in a certain situation. Past behaviour is used as an indicator to assess potential future performance

- Delivering a structured answer is crucial - research the STAR method to guide you

- Top Tip: Ensure your examples are varied and recent (the more recent the past behaviour; the greater the indication of future ability)

- Technical questions

- Practice! There are many online resources or books available with practice questions

- Questions may include basic accounting, valuation, brain teasers and mental arithmetic

- Top tip: Brain teasers – the key is not the answer; it is the how you derive at the answer. The interviewer is assessing your ability to formulate a logical and methodical response

- CV, cover letter and application questions

- Ensure you have thoroughly re-read each document and identify any obvious questions

- Top tip: Practice articulating your experience in a concise and structured manner out loud (it doesn't always sound the same as when you practice in your head).

- Industry related questions

- Interviewers will assess your interest, understanding and industry knowledge

- Top tip: Form an opinion – digest the information you read and form your own judgment. Use facts and statistics to back up your conclusions

Research

There are a number of readily available resources to help you prepare. Make sure you fully utilise all resources available to you. These may include:

- Online resources: Company website, press releases, annual reports, research publications, social media and online forums

- School career services and recruitment events

- Networks – academic Staff, alumni, peers, family and friends – even if they do not have a financial services background, they can help you practice questions

Your Questions

An interview is a two way process. It is an opportunity for you to assess if the company, role and culture is right for you. You will be given time to ask questions at the end of the interview, so you should ensure you use this time wisely.

- Plan questions to ask in advance - ensure they are relevant, well-thought-out and to the point

- Show you've done your research and use the opportunity to demonstrate your interest

Plan the Interview Day

Preparing as much as possible in advance of your interview day will remove many of the inevitable nerves associated with the process.

- Before the interview:

- Dress professionally. Plan you outfit the day before and ensure you wear corporate attire

- Be Punctual. Plan your route and account for delays in public transport

- Aim to arrive 15 minutes before your interview start time. Contact us if problems arise and ensure you have noted the name and contact details of who to contact should this happen

- Take a notebook, a pen (that works) and a calculator. Take a copy of your CV and application form

- Remember: Be polite to everyone you meet, your interview begins as soon as you walk through the door of the building ore recent the past behaviour; the greater the indication of future ability)

- During the Interview:

- Ensure your mobile phone is turned off

- Greet your interviewer(s) with a firm handshake. Remember their name(s)

- Maintain eye contact with your interviewer(s) and be aware of your body language – sit upright, don't fidget and smile!

- Listen carefully to questions you are asked. If you are unclear about anything, ask for clarification

- Be honest. Back up your answers with real examples. If you exaggerate or lie it will show up in pre-employment checks

- Relax - whether you are successful or not, the interview is a valuable learning experience. Make sure you get something out of it.

- Close the interview – thank your interviewer for their time. If you've enjoyed the experience and you look forward to hearing about the next steps – tell us

- After your Interview:

- Be responsive. Following the interview, go back to your recruiter and continue to build a relationship

- If you are offered a position it is unprofessional to renege (to accept and then later decline). This could be the first impression you create in the industry - you never know what the future holds

Asset and Liability Management (ALM): the practice of managing risks that arise due to mismatches between assets and liabilities of the financial institution.

Bond: an instrument of indebtedness of the bond issuer to the holders. It is a debt security, under which the issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay them interest (the coupon) and/or to repay the principal at a later date, termed the maturity date

CAGR: "Compound Annual Growth Rate" – the year-over-year percentage growth rate of an investment over a specified period of time

Capex: Acronym meaning Capital Expenditures, that are funds used by a company to acquire or upgrade physical assets such as property, industrial buildings or equipment. This type of outlay is made by companies to maintain or increase the scope of their operations

D &A: Acronym meaning Depreciation and Amortization, a category of expenditure by which a company gradually records the loss in value of a tangible (Depreciation) and Intangible (Amortization) asset

Deleveraging: Reduction of the leverage ratio, or the percentage of debt in the balance sheet of a single economic entity, such as a household or a firm.

Discount rate: The interest rate used in discounted cash flow analysis to determine the present value of future cash flows. The discount rate takes into account the time value of money (the idea that money available now is worth more than the same amount of money available in the future because it could be earning interest) and the risk or uncertainty of the anticipated future cash flows (which might be less than expected).

EBITDA: Acronym meaning Earnings Before Interest, Taxes, Depreciation and Amortization

EBIT: Acronym meaning Earnings Before Interest and Taxes

ETF: Exchange traded funds. An exchange traded fund is an investment fund traded on stock exchanges, just like stocks. An ETF holds assets such as stocks, commodities or bonds, and trades close to its net asset value over the course of the trading day.

EV: "Enterprise Value" – Equal to Equity Value plus Net Debt (or minus Net Cash)

FCF: "Free Cash Flow" – Measure of cash generation used in fundamental valuation of a business. Equal to EBIT x (1 - tax rate) + depreciation and amortisation - changes in working capital - capex

Forward interest rates: An interest rate that is specified now for a loan that will occur at a specified future date. As with current interest rates, forward interest rates include a term structure that shows the different forward rates offered to loans of different maturities.

Hedge: an investment made in order to reduce the risk of adverse price movements in a security, by taking an offsetting position in a related security, such as options or short sales.

LTM: Acronym meaning Last Twelve Months

IRR: Acronym meaning internal rate of return. The IRR corresponds to the rate of return on an investment. The IRR of a project is the discount rate that will give it a net present value of zero

Market Cap: Market capitalisation or market cap is a value of a corporation as determined by the market price of its common stock (shares). It is calculated by multiplying the number of outstanding shares by the current market price of the share

Market liquidity: an asset's ability to be sold without causing a significant movement in the price and with minimum loss of value.

Opex: Acronym meaning Operating Expenditures, a category of expenditure that a business incurs as a result of performing its normal business operations

Payout ratio: The amount of earnings paid out in dividends to shareholders

Shareholder loan: an instrument used to distribute cash to shareholders while minimising a company's tax liability. Not typically included within net debt

Swap: highly liquid financial derivative instruments in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another.

Swaption: An option granting its owner the right but not the obligation to enter into an underlying interest rate swap. A payer swaption gives the owner of the swaption the right to enter into a swap where they pay the fixed leg and receive the floating leg. A receiver swaption gives the owner of the swaption the right to enter into a swap in which they will receive the fixed leg, and pay the floating leg.

Ultimate forward rate (UFR): the theoretical forward interest rate to which forward rates converge.

Yield to maturity: Discount rate at which the sum of all future cash flows from the bond (coupons and principal) is equal to the price of the bond.

".

".