The first week of the internship will be a firm-wide orientation, comprised of training sessions and an overview of our business structure and strategy. We define all elements of the internship program and what it takes to succeed. You will also have on-the-job training through the summer, will work closely with professionals at all levels, and be invited to networking and community events which are great to connect with others and give back to society.

Who we are

About Nomura Group

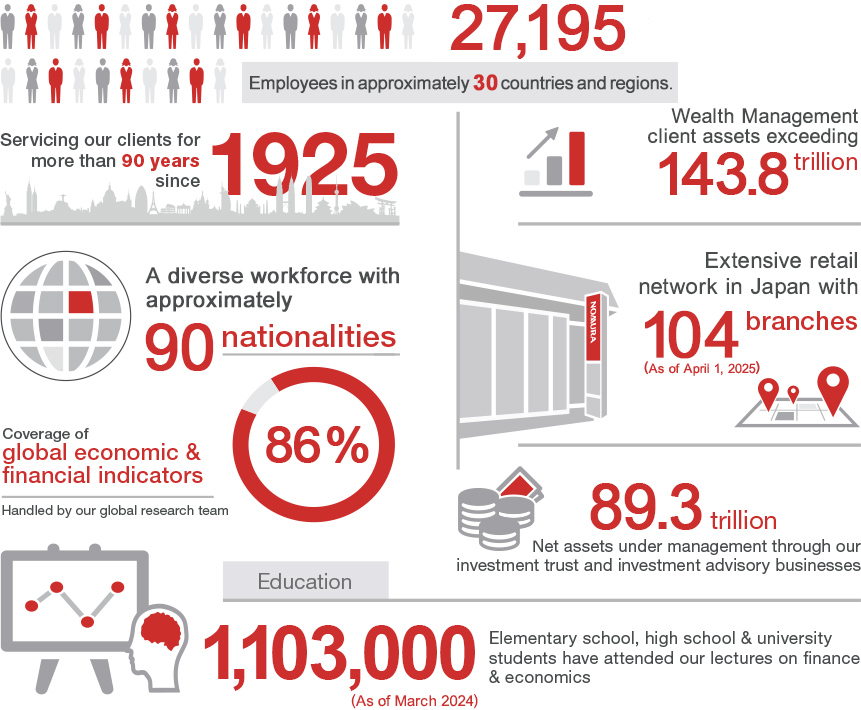

Nomura is a global financial services group with an integrated network spanning over 30 countries and regions. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three business divisions: Retail, Wholesale (Global Markets and Investment Banking), and Investment Management.

Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership.

Our Philosophy

Our Philosophy

Nomura in Numbers

Nomura in Numbers

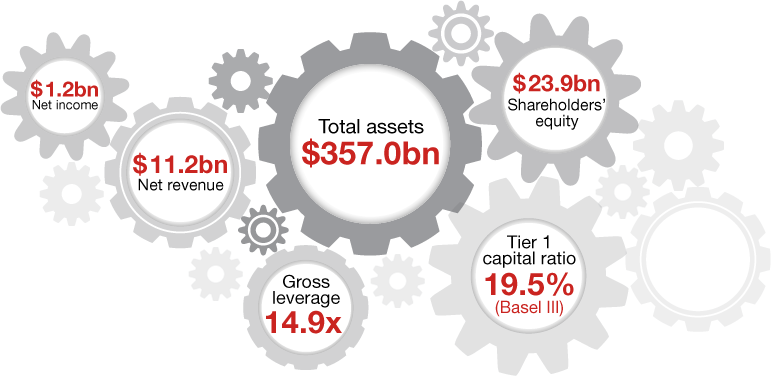

Key Financials

Key Financials

Our Global Network

Americas

2,200

Our Wholesale operation services local clients through nine locations in the United States, which represents the largest fee pool in global investment banking. Nomura also operates a boutique investment management firm specializing in high-yield investments.

Group companies in the AmericasEMEA

2,800

Headquartered in London with operations in 17 countries, our EMEA business has over 50 years of experience connecting markets East and West. We provide a wide range of solutions across Global Markets and Investment Banking to our corporate, institutional, government and public sector clients.

Group companies in EMEAAsia ex-Japan

6,400

Building on the presence we have established across 15 cities, we are laying the foundation to further expand our retail, wealth management and asset management capabilities in the Asia region where we see long-term economic growth.

Group companies in the Asia ex-JapanJapan

15,500

In addition to managing 122 trillion retail client assets and 22% of securities accounts in Japan, we are the country’s largest asset manager by assets under management We also provide a broad range of sales and trading as well as underwriting and advisory services to our clients in Wholesale.

Group companies in JapanOur Philosophy

Clients at the center of everything we do

Our priority is to customize solutions that align with clients' strategic interests

We believe in long-term partnerships created uniquely for each client

Long history in Asia

Our experience navigating Asia's cultures and customs is unrivaled

We are deeply rooted in Asia with a global footprint, enabling us to operate seamlessly across borders

Integrated global access

With access to over 30 countries and regions, and a presence on major stock exchanges worldwide, we connect markets East and West

Disciplined entrepreneurship

We seek creative solutions for clients with an astute understanding of the risks involved

We aim to equip our clients with a diverse and nimble portfolio to stay ahead of the market

Our Culture

Diversity &Inclusion

Our people are our greatest asset. We want to provide an environment that harnesses the diversity of our employees, and an inclusive and safe space for them to thrive.

Diversity and Inclusion is a business imperative and a key part of our strategy to hire, retain and develop top talent.

We achieve this through our programs aimed at mentoring, sponsoring and developing talent, as well as through our employee networks.

Employee Networks

Women in Nomura

For gender equity

Mental Health

For mental wellbeing

Pride Network

For equity across sexual orientations

Life and Families

For life beyond work

Corporate Citizenship

We recognize the important role we have in resolving environmental and social issues such as climate change and widening income inequalities. We work on several multi-year charity partnerships that guide our corporate grant-giving, employee fundraising and volunteering opportunities.

Our key charity partners:

Our Services

Retail

Nomura's Retail division provides a broad range of financial products and services to individual and corporate clients in Japan through its nationwide network of branches as well as online platform and call centers. We differentiate ourselves through our consulting-based approach, focusing on understanding the needs of each client and providing tailored solutions from investment to inheritance and succession planning.

View the retail site

Wholesale

Nomura is dedicated to servicing a diverse range of clients globally, including institutional investors, financial institutions, corporates, financial sponsors and government entities. Our Wholesale division comprises of Global Markets, which offers research, sales and trading of global securities, Investment Banking, which offers capital raising and advisory services, and International Wealth Management, providing tailored investment, financing and wealth planning solutions to high-net-worth clients.

View the Wholesale site

Investment Management

Nomura's Investment Management Division is responsible for the firm's asset management business. It brings together the investment management capabilities of Nomura Group companies, including Nomura Asset Management with its strengths in traditional asset classes, and group companies with investment experience in alternative assets such as private equity, private debt and aircraft leasing.

Investment Management leverages the know-how and expertise of the entire group to deliver added value for our clients across various asset classes, from traditional assets such as stocks and bonds to alternative assets such as private equity. We aim to provide a wide range of investment opportunities and solutions to meet the diverse needs of our clients.

By enhancing the asset management business and expanding investment capabilities, we strive to achieve organic/inorganic growth.

View the Investment Management siteWhat we do

Built to value ideas

Nomura provides investment banking services across the Asia Pacific region. We have a client-centric model and continue to make significant enhancements to our investment banking platform, global distribution, structuring expertise and product capabilities.

We continue to significantly increase our global footprint where we believe we have a competitive advantage and can best serve our clients, employees and shareholders. By putting our clients at the center of everything we do, we provide high value-added solutions and contribute to economic growth as Asia’s global investment bank.

In Asia ex-Japan, we recruit students and graduates mainly for the following divisions:

Investment Banking

Our Investment Banking Division provides a variety of advisory and capital-raising solutions to corporations, financial institutions, governments and public-sector organizations around the world. Our global teams act as geographic, product and industry specialists.

Corporate Finance Advisory: Sector and country coverage professionals are critical in identifying and analyzing deal opportunities and managing client relationships. The ideas generated can have a tremendous impact on a sector.

Global Finance and Capital Raising: Global Finance is a combination of product experts, who are focused on providing tailor-made client solutions in debt or equity financing. The group works closely with Corporate Finance, M &A and Global Markets to originate structure and execute deals across the globe.

We deliver Asia to our clients – accessing deep pools of liquidity and dynamic growth markets, with cross-border collaborations in M &A, DCM, ECM, and solutions businesses.

Global Markets

Nomura's Global Markets Division handles client transactions for financial institutions, corporates, governments and investment funds around the world. We act as market makers, trading in fixed income and equity securities, including currencies, interest rates and credit in cash, derivatives and structured products. We have taken market-leading positions across the globe by leveraging the strength of our talent, client relationships and technology.

By developing strong relationships with our client base through consistent interaction, independent advice and pre-eminent access to Asia, we have built a powerful global franchise across interest rates, currency and credit products. Our client services cover both high-volume flow products and carefully tailored structured solutions. We have adapted to the changing financial landscape to build a client centric focus differentiated by innovation, electronic and service excellence and market-leading derivatives capabilities.

Corporate Infrastructure

Corporate Infrastructure Division is what underpins the success of the entire organization. It is internationally renowned and structured to deliver a world-class client service. We rely on it to build and support the business, helping us deliver innovative financial solutions that set Nomura apart in the global marketplace.

In our highly competitive and fast-paced industry, strong infrastructure teams are fundamental to our success. Work in these areas (Compliance, Finance, Operations or Technology) with us and you will operate at the forefront of your field, as well as gaining a valuable insight into how Nomura operates on a global scale.

Our People

Talented people to drive our business forward

Nomura believes in harnessing the ambition of talented and intelligent people to drive our business forward. Our graduates' entrepreneurial spirits are helping us to realize our strategy to become Asia's global investment bank. Hear how Nomura impressed them, their experiences as interns and graduates and the evolution of their roles and responsibilities since joining.

Meet people from our Asia ex-Japan region

Charlton Leung

Global Markets

Meet Our People in Global Markets

Meet Our People in Investment Banking

Leveling Up

Corrinne Teo

Co-Head of GM Sales for Asia ex-Japan & Global Head of Flow Credit Sales

Aleem Jivraj

Chief Operating Officer, Global Markets

Avon Neo

Head of Private Bank Sales

Sonal Varma

Chief India & AeJ Economist

Corrinne Teo

Co-Head of GM Sales for Asia ex-Japan & Global Head of Flow Credit Sales

On January 7, 2009, I was sitting in the office as part of the newly-formed Nomura Asia ex-Japan Credit team and hoping my day would start well. It was an important day as it was our first day back in the office after Lehman Brothers’ Asia operations were acquired by Nomura in October 2008, and I recall experiencing a fair amount of performance anxiety.

And then the phone rang. In the space of the next hour, I remember selling 1 million of an Asian sovereign bond to a regional bank, an account I had previously covered at Lehman. I can never forget the client telling me that because it was my first day back, he was going to give me my inaugural trade at Nomura. This was a client who was carrying a significant loss from the Lehman bankruptcy. It was neither a large transaction nor a complicated structured product. It was a vanilla bond trade, yet one that filled me with a mixture of gratitude and relief after the emotional roller-coaster of going through the bankruptcy and trying to reboot my career.

It’s been almost 12 years since that Wednesday in 2009, but it and the preceding months after the collapse of Lehman on September 15, 2008, will remain imprinted in my memory.

Some of my personal reflections from that time:

Integrity

I realize that this is an over-used word in the modern business lexicon. For me, integrity means doing or striving to do the right thing every time, even when it is not convenient. It means to perform at our best because we never know which moment in our lives we will be judged on. Integrity is paramount to building any business and client relationship/franchise. We leave a little bit of ourselves with everybody we come in contact with, and over time, clients trust us only if we have integrity. Not every trade we do with a client will make them money, but we need to deal with them consistently in good faith so that in the long term, it’s win-win for everyone.

Passion &Performance

It is sometimes hard to be always emotionally invested in your work. However, it is important to have passion for your job, your team, internal stakeholders and clients. Another way of putting it is that you need to be a long-term optimist, but a short-term realist.

Personal Reputation

I was initially worried that clients would always remember me as the salesperson from the firm that went bankrupt. After all, a salesperson’s reputation is more integrated with the image of a firm than any other role. However, not every situation can be foreseen or anticipated. The Lehman episode teaches us that if we strive to consistently do the right thing when times are good, we as individuals or as a team, will be able to navigate the rough. In fact, the cultures of the top companies of the world depend on the innate goodness and professionalism of its employees which more than make up for systemic deficiencies. Our reputations are made on a daily basis. These are the little incremental things – worthwhile efforts, moments you were helpful to others, times you worked extremely hard over a weekend doing something important but not necessarily urgent – which after a lifetime, add up to something.

Balance

“Flutteringly, Floating in the breeze, A single butterfly,” is a beautiful haiku by Masaoka Shiki, the modernist and Western reformer during the Meiji period. Our Asia ex-Japan Credit business is ranked among the top 3 on the street, and one reason for our success is our laser-like focus in creating a sustainable, profitable business. Like the evocative image of the butterfly in the haiku, this is all about fine-tuning balance while working in consonance with the elements. While we can delight in the beauty of the butterfly, we must never forget the changes it has undergone to achieve that beauty. We should always focus on offering clients a product or service that has value for them. To achieve this, we should never shy away from making it known to them that both parties need to benefit from the relationship for it to be sustainable in the long term.

Stuart Oakley

Global Head of Flow FX

Five lessons from my first five years in banking

An acute feeling of imposter syndrome seemed ever-present in my first year in banking. The journey began in 1996 at Credit Suisse in London on the emerging markets fixed income trading desk, having joined straight from Manchester University.

Being the only non-Oxbridge and non-Ivy League graduate among my peers, I was impressed and stressed in equal measure at the mathematical brilliance of my peer group. I knew that to survive I had to bring my A game every single day.

Here are critical lessons I learnt in those first five years, all of which helped me get ahead.

1. Words are just as important as numbers

The banking industry is associated with numbers, and the complexity of some financial instruments requires some of the best mathematical minds. But never underestimate the importance of words. A trader is expected to know every nook and cranny of his trading book, what all the scenarios mean for each trading position and the tiny margins between success and failure. The trader who stands out will be the one who can communicate and articulate these clearly, concisely and in a well-structured manner. People love to be educated. People love to have their knowledge enriched. People love to make money.

2. Keep it simple

Very often in a bank, you will be the only expert for a particular job. So whether it’s a trade idea or a particular market nuance, get the message across clearly, concisely, and using simple, jargon-free language that everyone understands. This will make your audience want to partner with you. Rambling communications, being overly technical or taking forever to get to the punch line will get you nowhere. At the core of financial markets is the quest to understand imbalances between supply and demand over a given time period, as this is what makes prices move. Remember that when communicating.

3. Be an expert

Whatever your role is, know it inside out, back to front, upside down. You are the bank’s expert in your area/market. Live and breathe it. Make sure you are able to answer any questions that come from clients, colleagues or your boss.

4. Get to know people well

Banking is no different from any other industry in that you cannot achieve much without others. Getting to know the people around you makes a real difference. When you understand people, their character traits, what makes them tick, whether it be clients or colleagues, you will be able to get the best out of them, and them you.

5. Solutions not problems

Every job encounters obstacles on a daily basis. People do not need you to add to theirs. Do whatever you can to present a solution first before you flag a problem. It is human nature to avoid those who complain and bring problems. Conversely, people will always gravitate towards positive energy and a ‘can do’ attitude. The more willing business partners you have, the quicker you can get ahead.

Aleem Jivraj

Chief Operating Officer, Global Markets

If you observe some of the most successful people in business, such as Bill Gates or Jeff Bezos, you can’t help but wonder how they are able to fit so many different ventures into their life and career.

Managing one’s time is an important skill in the financial services industry too. Each person has to find what works for them and there is no one-size-fits-all approach. For example, one of the most productive people on the planet, Elon Musk, allocates his whole day in 5-minute blocks which is certainly a unique approach.

I’ve been fortunate to learn from some fantastic managers over the years, and also been influenced by many great books like Seven Habits of Highly Effective People . Here are some time management concepts that have worked for me:

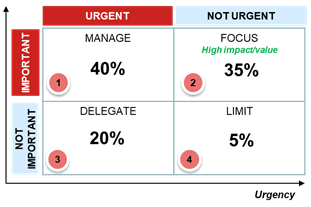

#1 Urgent vs. important: The Eisenhower Matrix

Everyone should prioritize urgent and important tasks (quadrant 1). But we have to do a certain number of non-urgent, less important “hygiene” tasks as well (quadrant 4).

The key is how to spend time between quadrant 2 and 3. The most effective people minimize the amount of time they spend on urgent, less important tasks by delegating or saying no. This won’t be easy, especially when you are early in your career or in a new job – but is essential. Instead, allocate your time to important, non-urgent tasks that typically take longer and will be more difficult to find time for, but have greater impact.

#2 Weekly or monthly goal setting

We all have to set objectives at work each year. But a year is a long time and it’s easy to lose track of priorities. So try setting your goals monthly or even weekly. On a Sunday evening or Monday morning, try spending 10 minutes to write down the key things you want to achieve that week - including possibly an activity that’s not urgent but important - that you’ve been putting off for later. Then when you inevitably get sucked into something urgent, you won’t lose track.

According to David Allen, inventor of the Getting Things Done methodology, “Self-management is about knowing what to do at any given moment.” I keep a post-it note by my keyboard with the top 6-8 focus items for the week, and whenever I have a few minutes to spare, I scan through it to make sure I’m staying on top of each item.

#3 Do the most difficult thing first, don’t procrastinate

Most people always have one or two items on their priority list that they really don’t want to tackle, and so leave it to the end. This can often lead to procrastination. Try tackling the most difficult things – tough conversations, difficult presentations or analyses – first and leave the more fun and easy tasks to the end. You’ll be able to get things done a lot faster.

As Mark Twain famously said: “If it’s your job to eat a frog, it’s best to do it first thing in the morning. And if it’s your job to eat two frogs, it’s best to eat the biggest one first.”

#4 Plan ahead – and look backwards

Plan what you want to achieve before you go into meetings and discussions. If you spend some time thinking about what you want to get out of each conversation, every meeting will be far more efficient.

Finally, at the end of each day or week, it is important to see how you did. Did you actually accomplish what you set out to get done? By tracking progress, you will soon get a clearer sense of how much you can get done in a given time. Over time, your ability to create a realistic schedule for yourself will get fine-tuned.

Time management is a skill that one can

learn and get better at over time. And if you do, it will allow you to be significantly more productive and impactful in your career and life.

Avon Neo

Head of Private Bank Sales

For the first time in over a century, the world has been dealing with a global pandemic that has shut businesses, upended lives, and disrupted and challenged our way of living. Through this period, I have had many insightful conversations with friends and family on what gives them true meaning.

Coping with such changes is what is commonly called a life transition and learning to master these challenging periods is probably the most essential life skill we need now. Massive life disruptions strike people at their very core, creating meaning vacuums in which it is common to feel frightened, overwhelmed and stuck. These life disruptions may be voluntary or involuntary. However, the transition process should be voluntary as we choose the steps we need to take as we turn some of these fears and anxieties into opportunities for growth and renewal.

From my experience over the last 20+ years in financial services, here are five simple tips to make whatever life transition you are experiencing go smoothly.

Be courageous

- The word courage came from the Latin word cor meaning heart – and the original definition was to tell the story of who you are with your whole heart.

- People with this virtue, very simply, have the courage to be imperfect.

- As Winston Churchill once said, “Criticism may not be agreeable, but it is necessary. It fulfils the same function as pain in the human body. It calls attention to an unhealthy state of things."

No one is perfect and it’s impossible to have an unblemished life. But what is critical is how you front up to things, make peace with your mistakes, learn from them and then capitalize as you catapult yourself in a different direction.

Be adaptable

- On many levels, Covid-19 will draw a clear divide between those who are adaptable and those who aren’t.

- To survive and thrive, you need to be adaptable. We have to constantly change, challenge ourselves, be open to new ideas and respond (not react) accordingly.

- As Jordan B Peterson says in 12 Rules for Life , “No one standing still can triumph, no matter how well constituted.”

I have often witnessed first-hand how crises shape leadership, the creation of new opportunities and how only those businesses who stay relevant by pivoting through change, ultimately thrive.

Ask for help when needed

- Contrary to what many may believe, asking for help is not a sign of weakness. It reflects resoluteness and an unyielding will to never give up.

- Your true friends will encourage you when you do well for yourself and punish you carefully when you do not.

- They will not tolerate your cynicism and destructiveness.

Be honest

- Honesty is not about just telling the truth – it is about being real with yourself and others about who you are, what you want and what you need.

- The worst type of dishonesty is self-deception. More often than not, it is an excuse to misrepresent one’s own shortcomings or to compensate for something.

- I have found that honesty cuts through bureaucracy, distraction, frustration and indecision. Stay with the facts – it will get you to where you want to go faster because you live how you really feel.

- As we go through transitions, we shed things – mindsets, routines, delusions, dreams. This is the way to clear out some unwanted parts of our lives to make way for the new parts to come.

Be kind

- As the author Charlie Mackesy says in The Boy, the Mole, the Fox and the Horse , “one moment snow is falling and the sun shines the next, which is also a bit like life – it can turn on a sixpence.”

- So, always be kind and considerate – you never know what life’s twists and turns will bring next. Karma can often be very painful and you may need the shoulders of the person to whom you gave a listening ear before.

Sonal Varma

Chief India & AeJ Economist

My first exposure to economics was in grade 11 and I took an instant liking to it because I found the subject very intuitive. I ended up majoring in economics more by accident and wanted to join a data analytics firm, but got rejected. I was disappointed then, but in hindsight, it was a blessing in disguise. I joined a firm focused on macroeconomic research and have been doing that since.

Below are a few tips from my career journey on how to motivate yourself, bring your A-game to work every day even after decades of doing the same thing, and how to deal with disagreements on your views. For those in the early stages of their careers, there are also a few easy suggestions on work and life in general.

On interest in economics and keeping the passion going:

What has kept me going is my passion for the subject. I enjoy what I do. This is important no matter which field you are in – you need to enjoy the work to be able to sustain it for long. There has also been constant learning that has kept me going – first about India, then more on Asia and global economy/markets. There is still a lot to learn. I enjoy interacting with different clients and policymakers, because you can make a difference. Finally, it is also important to find the right mentors. I found some good mentors early on and that helped keep my subject interest alive.

On what it takes to be successful in a competitive field:

Sell-side research is very competitive and clients receive hundreds of emails on the same subject, so the question is why should they read what you write?

- Content is key. You have to differentiate yourself and your product by adding value

- Communicate clearly and succinctly

- Be client-centric and approachable

- Stay ahead of the curve by anticipating what comes next

- Take risks. Being out of consensus can be difficult at times, but if you are convinced of your view, then it is worth the risk

- Have good policy contacts

- Build your credibility over time; it doesn’t happen overnight. Be consistent and people will start to trust you

- Don’t be complacent and constantly think of how you can improve. Ask for feedback and keep raising the bar for yourself

On dealing with disagreements with your views:

There are always different views on an issue and disagreements can be challenging to deal with. Before I form a view, I try to think through both the expected global economic backdrop and then the country nuances. So formation of the view itself is a comprehensive process which takes into account all possible outcomes to arrive at the most likely one. When people disagree, remember that they are rational and they are disagreeing with your view, and not you. You should ask the person why they disagree. Ask yourself whether this information requires you to re-assess your view. If yes, then change the view. If no, then explain why. In my work, I have to constantly re-assess my view as new information arrives.

Things I believe in and general advice for people in the early stages of their career:

- Work hard and be patient. Success comes over time.

- Work smart. Focus on the important quadrants – both urgent and not urgent (Stephen Covey).

- Never give up. Perseverance pays.

- Stand up and take your chance. If you are not ready to fail, then you are not ready to succeed.

- Health is wealth. Stay fit. No excuses.

- Invest in upgrading yourself. Read. Never stop learning.

- Invest only in what you understand. Be greedy when others are fearful, and vice versa.

- Spend time with those who really matter.

- Don’t compromise on your values. People should respect you, not your position.

- Be nice. Be fair. Be humble.

Meet people from other regions

Christopher Read

Corporate InfrastructureChristopher Read - Finance

BSc in Banking, Finance &Management, Loughborough University

The opportunity to be given real work and responsibility from day one impressed me and was a key reason I applied to Nomura. As an intern in the Fixed Income Product Control team I was responsible for producing daily profit and loss statements, which included reconciling various data feeds, comparing desk estimates and communicating any discrepancies to the traders. This gave me great exposure across the desk and with the traders. As I became more confident and efficient, I was given additional products and traders to cover.

Nomura excels at providing real opportunities to interns and graduates. In the current economic climate there are many challenges but also opportunities to get more involved. I have increasingly been given more responsibility, while some of my friends are still doing similar roles to when they started.

The graduate training included technical and soft skills sessions. The soft skills "Delivering powerful presentations" training was particularly valuable - our pitches were recorded and then replayed, which was really helpful and informative.

My responsibilities have steadily grown since joining the rotational graduate program. I have been heavily involved in several insightful pieces of analysis for senior management. In Cost Management &Analytics I developed an internal cost allocation process, improved the content and insight of internal Management Information (MI) and worked on delivering several cost saving initiatives. In the Regulatory Reporting team I have taken ownership of several key processes and reports and recently played a key project role in the delivery and reporting of the new CRDIV Liquidity Coverage Ratio (LCR) to the UK Regulator (PRA).

My top tip for future interns is flexibility and networking. You have to be flexible in your approach to work. Be ready to take on new projects and tasks that may be outside your remit. Be proactive and don’t be afraid to challenge the status quo.

Rachel Peters

Corporate InfrastructureRachel Peters, Corporate Infrastructure

B.S. in Computer Science, University of the West Indies

I knew I wanted to return to Nomura because of the intimate team sizes that allowed me to get involved with amazing projects, not only within my team but across others. The company is at a turning point where we are implementing great new technologies to push our business further which gives us technologists a vast amount of experience.

In order to have the best internship experience, I believe it is paramount to approach your mentors and peers in person to get the most out of your interactions; it is more beneficial and helps build closer connections with others. The summer analyst program provided an all-encompassing view of the business which gave the implementation of our IT projects a deeper purpose.

Chhavi Inani

Corporate InfrastructureChhavi Inani, Corporate Infrastructure

M.S. in Business and Information Systems, New Jersey Institute of Technology

I joined Nomura as a Summer Analyst and was fortunate enough to stay on as an intern for a full year, followed by full-time employment. I have worked on three different teams across multiple projects and have had the chance to learn something new each time. Nomura’s investment in junior talent is very impressive. The structure of the internship program motivated, guided and prepared me for the role proving to be remarkably rewarding.

My advice for anyone beginning their internship with Nomura is to never be afraid to ask for help. Take the time to connect with your colleagues. Go that extra mile. Go to the trainings and speaker sessions that are offered and be curious. These are all things that have served me well.

Our Programs

We’re looking to recruit individuals who are motivated

Graduate Programs

Graduate Programs

Internship Programs

Internship Programs

Find out more about our current opportunities for students and graduates here.

Download our Campus Recruitment Factsheet

Graduate Programs

Our 2-year program differs depending on the division you join. Basic training will be provided at the start to get you ready for work. Some divisions have rotations across functions, giving you well-rounded skills. Others will train you to be a specialist. You will have continuous support from the team as they provide you with feedback and career advice through the length of the program.

Internship Programs

Summer Internship

Our 9-10 weeks internship starts with orientation, followed by business insight sessions to give you an understanding of what we do. You will get hands-on experience and many networking opportunities during your internship. The program serves as a key pipeline into our Graduate Analyst Program in Asia.

6-month Internship

This internship experience includes building machine learning solutions, working with data scientists and engineers and learning cloud computing. You will get on-the-job training and many networking opportunities, The program serves as a key pipeline to our Graduate Analyst Program.

Graduate Internship

Our 12 weeks internship provides students in their final year of study the opportunity to get hands-on experience in sales, trading, structuring or research. During the orientation, you will meet your peers and as assigned buddy who will help you get settled and provide support though the entire period of the internship. The program serves as a key pipeline to our Graduate Analyst Program in Asia.

Our Programs

Please click here to find out about the programs we are currently inviting applications for in Asia ex-Japan.

Campus Events

Come and meet us

Campus Events

Campus Events

Apply Now

See what opportunities are available to you

Search &Apply Application Process

Application Process

Interview Tips

Interview Tips

FAQs

FAQs

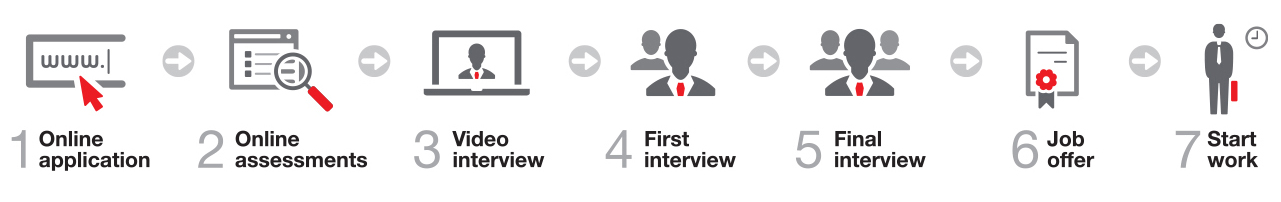

Application Process

1. Online application

You will need to apply directly on our careers website, and will need to submit an online application form together with your CV. We accept applications from all academic disciplines.

2. Online assessments

Once you have submitted your application you will receive an email invitation to complete online assessments.

3. Video interview

After completing and passing your online assessments, we will review your application. Successful applicants will be invited to a video interview.

4. First interview

First-round interviews are typically conducted over the phone with representatives from the business area you applied to.

5. Final interviews

If you are successful in the first-round interview, you will be invited to attend our final interviews or Superday. Superday consists of a couple of face to face interviews, either in person or virtually. Interviews may contain competency based questions but you should also expect technical questions and be prepared to explain your interests and motivations.

Interview Tips

There is no need to be nervous at interview - we want you to do well and to show us your potential and what you can do. Preparation is essential and well prepared candidates are more confident, provide more thorough and focused answers and are therefore more likely to be successful.

Use our step by step guide to ensure you take the time to prepare wisely; the key is to ensure your preparation is carefully planned and focused.

Step 1 - Focus: structure and prepare

Preparing for, and being interviewed is similar to taking an exam. You won’t have time to cover everything. Instead, identify key points and focus on the relevant material.

First, congratulate yourself on being shortlisted for interviews and have confidence in your abilities. Then, ask yourself the following questions:

-

What will the interviewers want to know?

- An interview is not about divulging everything you know. Instead, focus on what is relevant to the company and the position you are applying for.

- To identify what is most relevant, understand the role, its requirements and the key skills and competencies needed to succeed.

-

How are you going to sell yourself?

- What is your unique selling point? What sets you apart from the competition?

- How do you want the interviewers to remember you after the interview? What key points do you want them to recall?

-

How will you be assessed?

- You can’t start your preparation until you know what you are preparing for.

- Read the interview format thoroughly to identify how you will be assessed (i.e., interviews, case studies, tests). If you’re unsure, ask.

-

What are the core competencies required for the role?

- Your interview performance and success will ultimately depend on how well you are able to explain your core competencies, mapped against those required by the company for the specific role.

- What examples do you have to demonstrate each competency? Have you considered examples outside academia (i.e., sports, music, drama, volunteering, charity, mentoring, societies or other extracurricular activities)?

- What achievements are you most proud of and why? Which competencies do they demonstrate?

Step 2 – Interview questions

Interviewers will use a variety of questions to assess your ability against each competency. Ensure you are familiar with each type of question and how to structure your answers accordingly.

Types of interview questions may include:

-

Competency based questions

- These require you to provide real-life examples to explain how you behaved in a certain situation. Past behavior is used as an indicator to assess potential future performance.

- Delivering a structured answer is crucial. Research the STAR method to guide you.

- Top Tip: Ensure your examples are varied and recent. The more recent the past behavior, the greater the indication of future ability.

-

Technical questions

- Practice! There are many online resources or books available with practice questions.

- Questions may include basic accounting, valuation, brain teasers and mental arithmetic.

- Top tip: Brain teasers – the key is not the answer. It is how you arrive at the answer. The interviewer is assessing your ability to formulate a logical and methodical response.

-

Industry related questions

- Interviewers will assess your interest, understanding and knowledge of the industry.

- Top tip: Form an opinion – digest the information you read and form your own judgment. Use facts and statistics to back your conclusions.

Step 3 - Research

There are a number of readily available resources to help you prepare. Make sure you fully utilize them. These may include:

- Online resources: Company website, press releases, annual reports, research publications, social media and online forums.

- School career services and recruitment events.

- Networks – academic staff, alumni, peers, family and friends. Even if they do not have a financial services background, they can help you practice.

Step 4 – Your questions

An interview is a two-way process. It is an opportunity for you to assess if the company, role and culture are right for you. You will be given time to ask questions at the end of the interview. Ensure you use this time wisely.

- Plan questions to ask in advance. Ensure they are relevant, well-thought-out and to the point.

- Show you’ve done your research and use the opportunity to demonstrate your interest.

Step 5 – Plan the interview day

Preparing in advance for your interview will remove many of the inevitable nerves associated with the process.

In-person interviews

-

Before the interview:

- Dress professionally. Plan your outfit the day before and ensure you wear corporate attire.

- Be punctual. Plan your route and account for delays in public transport.

- Aim to arrive 15 minutes before your interview start time. Ensure you have the name and contact details of the person to contact, should there be any problems.

-

During the Interview:

- Ensure your mobile phone is turned off.

- Greet your interviewer(s) with a firm handshake. Remember their name(s).

- Maintain eye contact with your interviewer(s) and be aware of your body language – sit upright, smile and don’t fidget.

- Listen carefully to questions you are asked. If anything is unclear, ask for clarification.

- Be yourself. Be genuine in your answers so the interviewers can get to know you.

- Close the interview. Thank the interviewer(s) for their time.

-

After the Interview:

- A good idea is to send a thank you email to your interviewers. Tailor the email to the discussions you had during the interview.

- Follow up with your recruiter on next steps.

-

Virtual interviews:

- Stay in a private room with minimal disturbance

- Be aware of the background that interviewers may see

- Position your camera at eye level and ensure sufficient lighting

- Log in early and have a trial where possible

- Have your mobile phone next to you in case there are technical issues