02

Nomura: Connecting Markets East & West

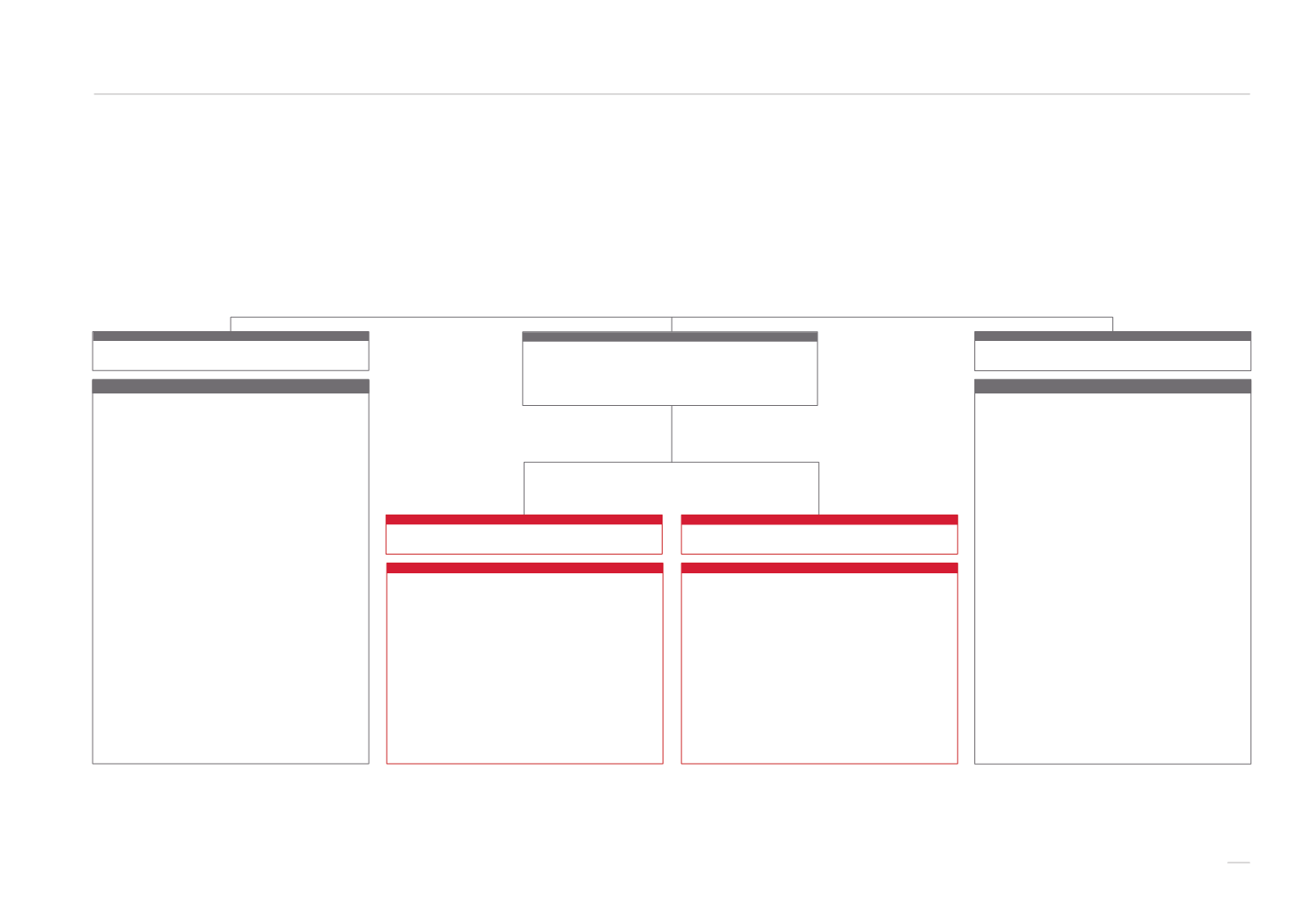

Asset Management

Retail

Global Investment Banking

Global Markets

Wholesale

Retail Client Assets:

$906 billion

1,2

Nomura offers a broad range of

financial services to its individual

and corporate customers through

its 160 branches and other offices

in Japan, its call center, and its

internet services.

Global Wholesale Market Share: 4%

1, 3

Development of services that

include underwriting of bonds and

stocks, M&A advisory and offering

solutions tailored to client needs.

Global development of sales

and trading in bonds, stocks,

foreign exchange, and derivatives

businesses for institutional investors.

Net Assets Under Management:

$317bn

1,4

Nomura’s asset management

business is global in scope. Individuals

and institutions in Japan and overseas

entrust the management of their

assets to Nomura, and Nomura

responds by providing investment

advisory, investment trust and other

related services.

Nomura is an Asia-based financial services group with an integrated global network spanning over 30 countries. By connecting

markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three

business divisions, Retail, Asset Management, and Wholesale (Global Markets and Investment Banking). Founded in 1925, the

firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and thought leadership.

1. As of September 30, 2014.

2. Conversion of Yen figures to U.S. Dollars has been calculated at the exchange rate of USD 1 = JPY 109.66, i.e. FRB noon rate as of September 30, 2014.

3. Market share based on combined revenues of 12 global banks (MS, GS, Citi, BAML, JPM, CS, UBS, DB, BARC, RBS, SG and BNP) + NOM. All peers as per actual reported basis.

4. Net assets under management for Nomura Asset Management, Nomura Funds Research and Technologies, Nomura Corporate Research and Asset Management, and Nomura Private Equity Capital.

Conversion of Yen figures to U.S. Dollars has been calculated at the exchange rate of USD 1 = JPY 109.66, i.e. FRB noon rate as of September 30, 2014.

Strengths:

∙

∙

Sophisticated consulting

capabilities

∙

∙

Abundant lineup of products

Strengths:

∙

∙

Top-level syndication and

execution

∙

∙

Strong network

Strengths:

∙

∙

Strong client base

∙

∙

Product syndication capabilities

∙

∙

Sophisticated financial technology

Strengths:

∙

∙

Japan’s largest asset

management company

∙

∙

Creative product offering

∙

∙

High-quality portfolio

management capabilities